Evidence Of Earnings

Your own loan provider may not work a thorough check into your credit report, nonetheless they need some verification to pay the borrowed funds. Delivering proof of constant earnings increase your odds of qualifying the emergency account.

Compare Offers

How would you are sure that the most effective loan provider obtainable any time you didn’t try several systems? The majority of financing networks demonstrate rates of interest plus the possibility of acceptance whenever you qualify for the prequalification techniques. However, these prequalification question cannot show up on your credit history. Ergo, it is good practice to compare provides and choose the greatest loan provider obtainable.

Bring In An Authorized

Occasionally, you will possibly not meet the lender’s needs. An answer for these situation should entail a cosigner just who’ll attest to you. This escalates the odds of acquiring the mortgage authorized. But keep in mind not absolutely all loan providers accept of cosigners.

Official Program

After qualifying the mortgage, your own lender offers a regular application form to complete. There’s a timeframe for distribution within this software, plus the facts required vary by lender.

Various Other Options To No-Credit-Check Financial Loans

You should not call it quits if you cannot get a no credit check loan and think you have lack choice. Aside from no credit score assessment financing, there are various other choices you can utilize to improve debt standing. Here are some guidelines:

Fixing Your Credit Score

Your credit rating is most likely why you were declined the borrowed funds. Fixing your credit rating is considered the most effective technique to increase monetary circumstances. It really is a time-consuming and difficult chore, nevertheless will pay off ultimately because an increased credit history improves your odds of getting that loan.

Improvise

You are able to scour the market for house and assets to market to have liquid money in a crisis. It might be best choice to help make since offering that which you own incurs no extra expenses.

Ask Your Boss

When you have an outstanding working relationship along with your boss, you are able to inquire about a brief mortgage your loan provider can withdraw out of your income. Before recognizing the mortgage, you will want to discuss the details of the arrangement, such as for example simply how much is pulled from your own income as well as just how long. This program produces a far better alternate than selling your valuables.

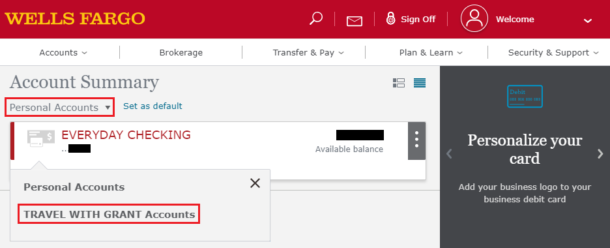

Contact Your Financial

For those who have a current profile, you’ll contact your financial for a zero-percent overdraft. The quantity of the overdraft would be predetermined. You should make sure that you do not look at the restrict, or perhaps you’ll become charged an overdraft fee. You can even inquire about a customized mortgage from the lender. As they are conscious of your financial situations, they may be able customize financing in order to meet your requirements.

Relatives and buddies

If you’ve exhausted all other selection whilst still being cannot get that loan, you can look at borrowing from group or pals. Your relative should talk about the mortgage words, and you ought to manage the essential link plan with the exact same admiration might offer a loan obtained from formal financial institutions.

Make sure you help make your repayments punctually. Wages as you were working with an impersonal loan provider. Your chance dropping the cooperation should you decide miss repayments or deal with the deal with levity.

FAQs About No Credit Score Assessment Financing

- How To Determine If My Credit History Try Worst?

You can easily acquire the credit history legitimately from some of the credit agencies in the United States. Using this report in addition to FICO scale, it is possible to find out your credit rating. The typical credit history comes somewhere within 300 and 850.