A new report through the Pew charity Trusts phone calls into concern the main advertising reports used to sell payday advance loan to 19 million Us americans yearly.

Payday advance loan include charged as an easy and simple answer to an urgent financial crisis a an inexpensive, brief loan which will help the debtor get right to the next pay check. Even so they’re not.

Many clientele (58 percent) regularly have trouble meeting their unique monthly spending. On their behalf, the loan was an easy way to manage a persistent diminished funds. Actually, Pew found that seven regarding 10 consumers make use of these financing to cover normal living expenses, such as for example book, resources and credit card debt.

The best expenses and duration of these financial loans become a?highly unpredictable and bear little similarity on their two-week packing,a? Pew discovered. Best 14 per cent of those who take aside a payday or lender deposit advance loan can pay it in full.

a?Our research shows payday advance loan include unaffordable,a? said Nick Bourke, movie director of Pew’s small-dollar financing research study. a?The average borrower just can’t afford to pay off an average payday loans which calls for $430 regarding the further pay check.a?

A big part mentioned they enjoyed the service payday lenders render a quick profit and friendly provider

a?Pew unfairly paints the entire sector with a diverse clean,a? CFSA stated in a statement. a?In our recent economic climate and constricted credit score rating marketplace, it is important that customers possess credit score rating options they have to deal with her economic issues.a?

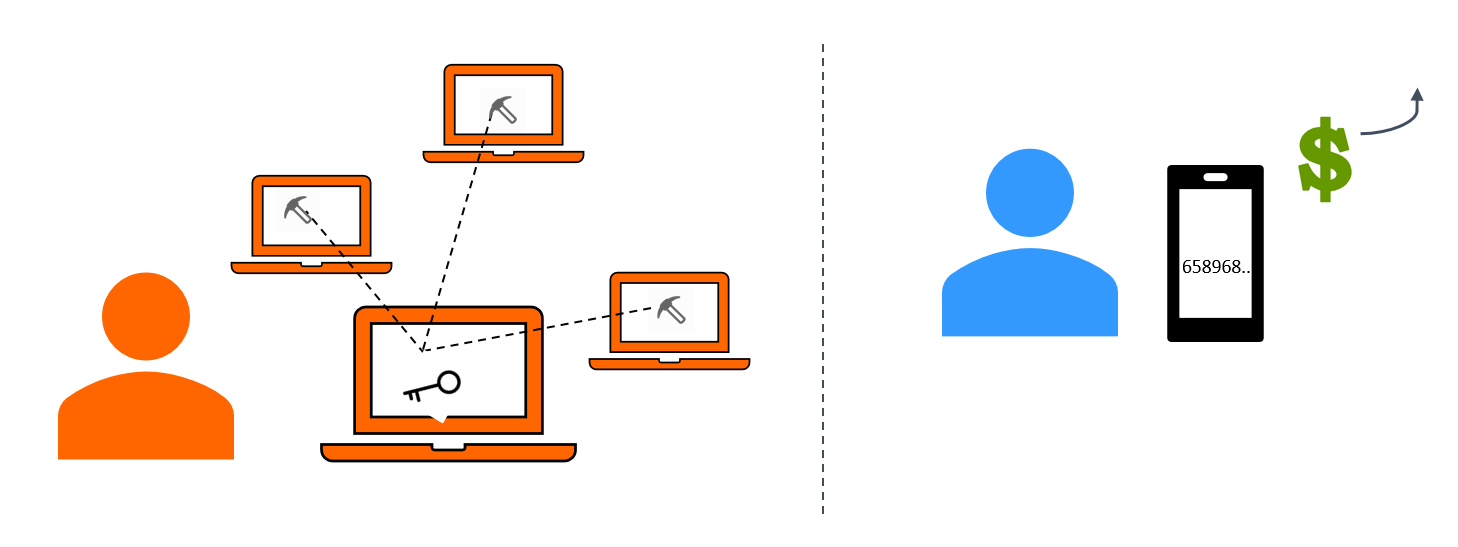

For anyone struggling to manufacture stops satisfy, payday advance loan is mighty pleasing. They can be very easy to become. They’re confidential, so friends don’t have to learn about all of them. People believe the marketing and advertising that represent them as a short-term repair for a temporary cash-flow issue.

a?That attracts individuals because they do not want more personal debt,a? Bourke revealed. a?They don’t want another expenses throughout the heap. They desire an in-and-out remedy, but also for most pay day loan individuals it does not workout by doing this. The truth is your normal payday loans debtor is during financial obligation for 5 several months of the season and will pay $520 in money fees.a?

CFSA mentioned their customers give a prolonged fees strategy, at no extra cost, if customers cannot repay her loan when due. Pew proposes the vast majority of individuals don’t benefit from this product where granted.

To put it simply, clients bring a?unrealistic expectationsa? concerning the total cost of the loan. Pew discovered that they understand the price they’re going to spend upfront a generally $55 for a $375 financing a nonetheless they fail to take into account the adverse influence that loan have on their spending plan in 2 months with regards due.

a?The debts are actually tough or impractical to pay unless the debtor gets some kind of a windfall or a bailout,a? Bourke mentioned.

a?better, Friday came, you offered all of them your earnings, what you due all of them, which cleaned off that loan, but now you have nothing, and that means you need certainly to re-borrow to thrive the 14 days weeks.a?

Payday advance loan are usually sold in order to protect against bank account overdraft charges. Pew receive they don’t really eliminate that chances. Indeed, for approximately 25 % of consumers (27 %) an overdraft taken place whenever lender produced a withdrawal off their accounts.

Consumers expressed mixed attitude about payday loan providers. That https://guaranteedinstallmentloans.com/payday-loans-la/ they like getting on-the-spot credit score rating, but they’re annoyed by exactly how harder it’s to repay the loan.

Actually, some mentioned it’s too simple to have the cash. A majority in addition stated they believed rooked of the highest price of the mortgage.

Anyone told Pew researchers it was a a?sweet and soura? skills. Its nice when you get money and bad once you have to pay for it right back.

Lots of people use small-term loans if they’re quick on earnings. But as consumer advocates have long insisted and Pew professionals have now noted, all too often that quick financing does not solve the situation and could succeed bad.

a?Policymakers need certainly to pay attention to this research,a? Bourke stated, a?because it surely shows payday loans are not being employed as advertised.a?

Exactly how are they gonna produce the money a $400 or even more a wanted to pay the mortgage completely?

Payday lenders believe they offer a?an important monetary toola? for those who require money to pay for surprise expenses or manage a shortfall between paychecks.